IRS Unveils Free Tax Filing Prototype

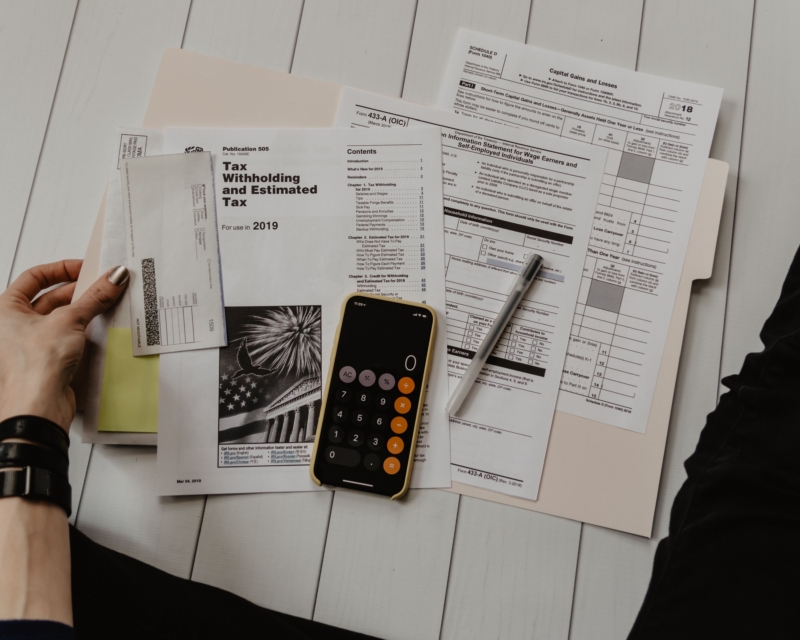

The Internal Revenue Service (IRS) has developed a prototype system to allow Americans to file their tax returns digitally and free of charge, potentially disrupting the tax-prep industry. The system, created in collaboration with the U.S. Digital Service, will be available through a pilot program for a small group of taxpayers starting in January 2024. This initiative was funded by the Inflation Reduction Act, which allocated $15 million to explore the creation of a direct filing program.

Currently, the IRS refers individuals seeking free filing options to a number of companies that provide free e-filing for eligible taxpayers. However, less than 3% of taxpayers utilize these options. Industry giants Intuit TurboTax and H&R Block offer free products for a narrower range of taxpayers but are not officially endorsed by the IRS. Others can use “Free File Fillable Forms” without professional guidance.

The IRS engaged the New America think tank to study a direct filing system and produce a report, expected to be released soon. However, the existence of the IRS prototype before the report’s release has raised concerns about predetermined outcomes. Sen. Mike Crapo voiced some concerns stating that “this suggests a pre-determined outcome and flies in the face of previous commitments Commissioner Werfel made to publicly consult Congress on a potential free-file solution, and for the IRS to not act without explicit legal authority”

The introduction of a government-backed free filing system could potentially disrupt the commercial tax-preparation market, valued at $14.4 billion in 2023. Which also highlights the IRS’s technological shortcomings compared to smaller countries like Estonia that offer government-supported free digital filing services.

The Inflation Reduction Act granted the IRS $80 billion over 10 years to enhance enforcement efforts, improve taxpayer services, and modernize its technology. The additional funding is aimed at combating tax evasion and better serving low and middle-income individuals.

The IRS’s plan also includes the creation of online portals for taxpayers to seek assistance from customer service representatives. This could endanger the services provided by tax-prep companies that differentiate themselves from the IRS by offering expert assistance from accountants.

Representatives from the tax-prep industry have expressed concerns about the direct filing program, arguing that it is unnecessary and will cost taxpayers billions of dollars. Intuit and H&R Block have spent significant amounts on lobbying efforts related to “tax system integrity” and “intellectual property protections”

Several NGOs currently offer free tax filing solutions to low income Americans and several companies compete over offering free services to retain customers. Whether the IRS’s new system will disrupt this industry remains to be seen.