Home Insurance Costs Continue to Rise in the US

As if inflation weren’t enough of a burden on American households, there’s another unseen assailant quietly squeezing the life out of family budgets: skyrocketing home insurance costs. Rising rates are placing an ever-tightening stranglehold on homeowners across the country, adding yet another layer of stress to an already overburdened populace.

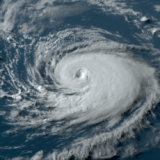

What’s driving this surge in insurance costs? Climate change, for one, has unleashed a wave of natural disasters—from wildfires to hurricanes—that companies are scrambling to cover. While it’s easy to understand the need for insurers to safeguard their own financial health, the impact on American families is nothing short of catastrophic.

Homeowners are now finding themselves in a Catch-22 situation. On one hand, theirpremiums are soaring, with many seeing their rates double or even triple in recent years. On the other, as the cost of living continues to climb, they must contend with higher grocery bills, energy costs, and interest rates on loans. This is a perfect storm of financial pressure that few families can weather.

The hardest hit are those in disaster-prone areas, where companies are quick to hike rates or, worse yet, pull coverage altogether. For these homeowners, finding new coverage can be a nightmare, often resulting in paying exorbitant rates or being forced to accept inferior policies with limited coverage.

It’s not just families feeling the pinch; the broader economy is also taking a hit. As home insurance costs rise, disposable income shrinks, dampening consumer spending and putting further strain on local economies. This vicious cycle of rising costs and reduced spending is a recipe for economic stagnation.

What’s the solution? It’s clear that more needs to be done at both the federal and state levels to rein in the costs and protect homeowners. Regulations that limit excessive rate hikes and promote competition could go a long way in easing the burden. Additionally, investment in resilient infrastructure and proactive measures to mitigate the impact of natural disasters could help stabilize the market.

In the meantime, American families are left to navigate this treacherous landscape with little recourse. It’s time for policymakers to take action and provide some much-needed relief to homeowners struggling to keep their heads above water. After all, a safe and stable home shouldn’t come with a crushing price tag.