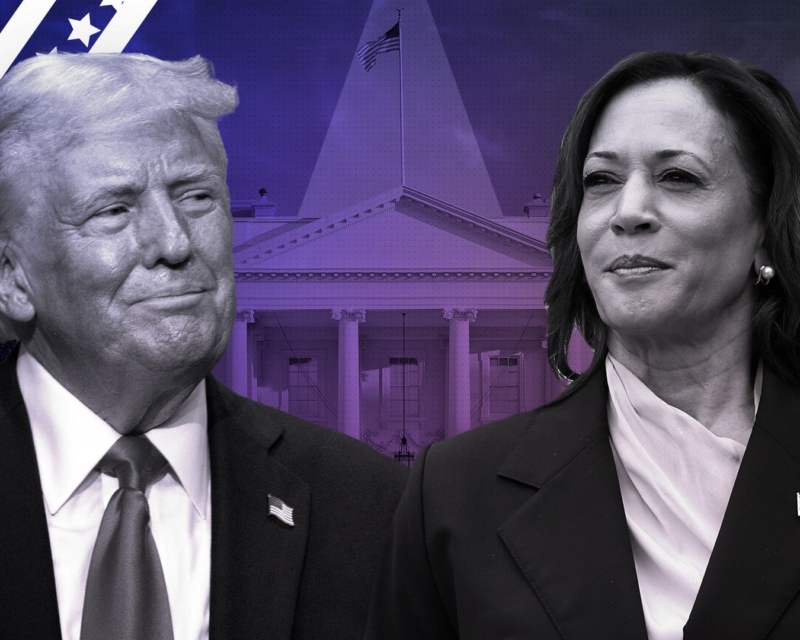

Uncertain Election Threatens Market Stability

Mike Schumacher, head of macroeconomic strategy at Wells Fargo Global, recently warned that the markets could turn “ugly” if the upcoming U.S. presidential election doesn’t produce a clear winner.

This possibility has cast a shadow of uncertainty over investors, who are already on edge due to the unpredictable political climate. In a world where markets thrive on stability, the prospect of a contested election could send shockwaves through the economy, stifling investment and leading to broader consequences.

When uncertainty reigns, investors pull back. Money that would normally be channeled into production and growth is instead held in reserve, waiting for the storm to pass. Without clear leadership in Washington, the financial world may stall, unsure of the policies that will follow. This paralysis creates a ripple effect across the economy. If companies are not investing in new projects or expanding operations, production inevitably falls.

For ordinary consumers, this could spell trouble. As production declines, the supply of goods diminishes. We’ve seen how fragile supply chains can be—especially in the wake of recent global disruptions—and a political crisis would only exacerbate these issues. The lack of investment could translate into empty shelves and higher prices for everyday items, from groceries to electronics. The uncertainty is already making buyers anxious, and a prolonged lack of clarity in the election results would only deepen the problem.

Schumacher’s warning highlights just how intertwined political stability is with economic performance. When leadership is in limbo, so too is confidence in the market. Businesses depend on knowing the direction of fiscal policies, regulations, and trade. If those factors are in doubt, it’s no surprise that investors and companies alike would hit pause. And while Wall Street is a world driven by complex models and strategies, at its core, it’s as simple as this: no one likes uncertainty.

The implications of a contested election extend far beyond a temporary market dip. If the political chaos drags on, the effects could be long-lasting, with a slow recovery for both investments and production. For now, markets are holding their breath, hoping for a decisive outcome. But as Schumacher suggests, if no winner emerges quickly, the consequences could be dire for the economy and consumers alike.