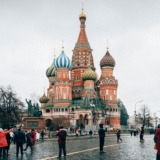

Major European Companies Suffer €100 Billion Losses from Russia Operations Due to Sanctions

In a significant blow to major European corporations, it has been revealed that a staggering €100 billion ($110 billion) in direct losses have been incurred by companies operating in Russia due to Western sanctions, according to a recent survey by the Financial Times. The study delved into the annual reports and financial statements of 600 European conglomerates, uncovering the extent of the damage inflicted by the geopolitical turmoil.

The survey shed light on the grim reality faced by 176 European firms, which were compelled to report asset impairments, foreign exchange-related charges, and other one-off expenses stemming from actions like selling, downsizing, or shutting down Russia-based businesses. These losses, however, only encapsulate the immediate and direct consequences of the sanctions, excluding the broader macroeconomic impacts stemming from the ongoing Ukraine conflict. These broader impacts encompass elevated energy and commodity costs.

It was noted in the report that this crisis had an unexpected beneficiary: energy and defense companies. The upheaval led to a surge in profits for these sectors, with the report specifically highlighting the robust performances of energy giants BP, Shell, and TotalEnergies, which together reported combined charges of $45 billion.

Notably, the energy sector bore the brunt of the losses, but the repercussions reverberated throughout various industries. Utility companies were hit hard, sustaining a direct blow of $16 billion, while industrial players, including prominent car manufacturers, experienced a loss of $15 billion. Financial institutions, including banks, insurers, and investment firms, weren’t spared either, as they collectively recorded over $19 billion in write-downs and other charges.

Intriguingly, despite the tumultuous climate, more than 50% of the 1,871 European-owned entities that operated in Russia before the conflict are still navigating the challenging terrain. The likes of UniCredit from Italy, Raiffeisen from Austria, Nestle from Switzerland, and Unilever from the UK are among those who continue to brave the uncertainty.

However, this persistence has been met with skepticism. Anna Vlasyuk, a research fellow at the Kiev School of Economics, emphasized that these companies are taking a high-stakes gamble. Vlasyuk highlighted the daunting hurdles that they face, including the heightened exit barriers set by Moscow, which increase the likelihood of expropriation, making the extraction of dividends almost impossible.

The situation has had far-reaching implications beyond Europe’s borders, too. Following Moscow’s military intervention in Ukraine, more than 1,000 Western companies withdrew from the Russian market due to the mounting pressure of sanctions, as indicated by Yale University analysts. Consequently, Russia shifted its focus toward non-Western allies, most notably China and India.

The economic landscape has witnessed a striking transformation. Chinese enterprises have adroitly filled the void left by their Western counterparts, positioning themselves as significant players. China’s ascendancy in the Russian market has even led to it overtaking the European Union as the top importer of Russian agricultural products, while concurrently competing with India for the title of Russia’s largest oil buyer. In a clear display of the robustness of this partnership, trade between Russia and China surged by nearly a third in 2022, culminating in a bilateral trade volume of $185 billion.

In fact, the burgeoning trade relationship has exceeded expectations, as officials from both nations have revealed that the ambitious $200 billion turnover goal set for 2024 could be accomplished even sooner than anticipated. This marks an intriguing twist in the narrative of global economic dynamics, underpinned by geopolitical tensions and shifting alliances.