Musk’s Momentary Setback: Tesla’s Woes and the Volatile Nature of Billionaire Fortunes

In a world where billions come and go at the whim of market fluctuations, the recent $15.9 billion dip in Elon Musk’s net worth might seem like a substantial blow. However, despite the reported loss, his financial empire remains firmly perched atop the global wealth rankings, a testament to the unparalleled heights of his financial prowess and the inherent volatility of the contemporary market landscape.

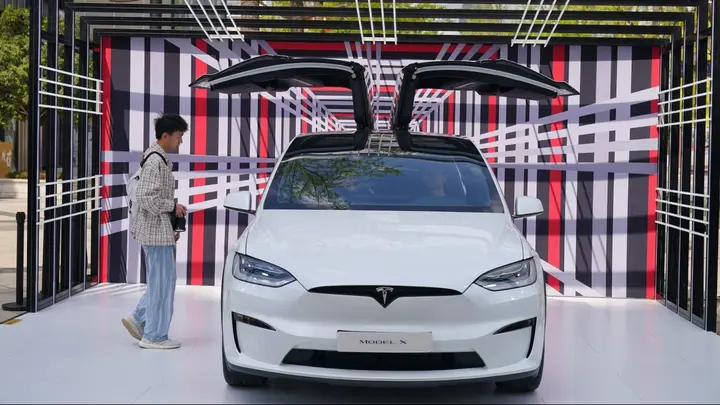

The tumble in his net worth, spurred by investor responses to Tesla’s underwhelming third-quarter financial results, offers a compelling snapshot of the tumultuous nature of the modern business realm. With Tesla’s stock witnessing a significant decline of over 9% following the unveiling of its financials, the ripple effect was keenly felt in Musk’s personal fortune, causing a dent that, by ordinary standards, would be cause for grave concern. Yet, in the realm of billionaire finances, this appears to be a mere fluctuation, a hiccup in an otherwise stellar trajectory.

While Tesla did record a 5% surge in total revenues, reaching $23.35 billion for the third quarter, the dip in diluted earnings per share by 37% from the previous year failed to meet analyst projections, casting a shadow over the company’s recent performance. As Musk took the stage during the earnings call, fielding inquiries on various topics including the much-anticipated Cybertruck, the spotlight fell not only on the company’s financial health but also on its future prospects and strategy.

The delicate dance of billionaire rankings saw Jeff Bezos momentarily seize the second-place position, only to be ousted shortly after by the resurgence of LVMH CEO Bernard Arnault. This fluidity within the upper echelons of wealth underscores the capricious nature of financial markets, where the ranking game is subject to a constant state of flux.

Amidst the market tremors and the relentless ebb and flow of fortunes, Musk’s enduring status as the pinnacle of wealth serves as a testament to his entrepreneurial acumen and his unwavering commitment to reshaping industries and driving technological innovation. While the current setback may give some pause for thought, it’s crucial to recognize the resilience that lies at the heart of Musk’s enterprise, and the potential for a swift rebound that characterizes the dynamic world of high-stakes finance.

As Musk and Tesla navigate the winds of change, one thing remains clear: the ebb and flow of billionaire fortunes is not merely a reflection of economic data points but a testament to the intricate interplay between business, innovation, and the ever-shifting tides of investor sentiment. It is within this volatile ecosystem that true titans are tested, where resilience and adaptability become the guiding principles in the pursuit of sustained success and lasting impact.