IRS Faces Scrutiny Over Tax Audits Amid Biden’s Pledge

President Joe Biden’s reiterated pledge to refrain from increasing taxes on Americans earning less than $400,000 per year has come under scrutiny as the Internal Revenue Service (IRS) plans to hire 3,700 new employees to target wealthier taxpayers. This move has raised questions about the IRS’s ability to accurately identify and audit high-income earners.

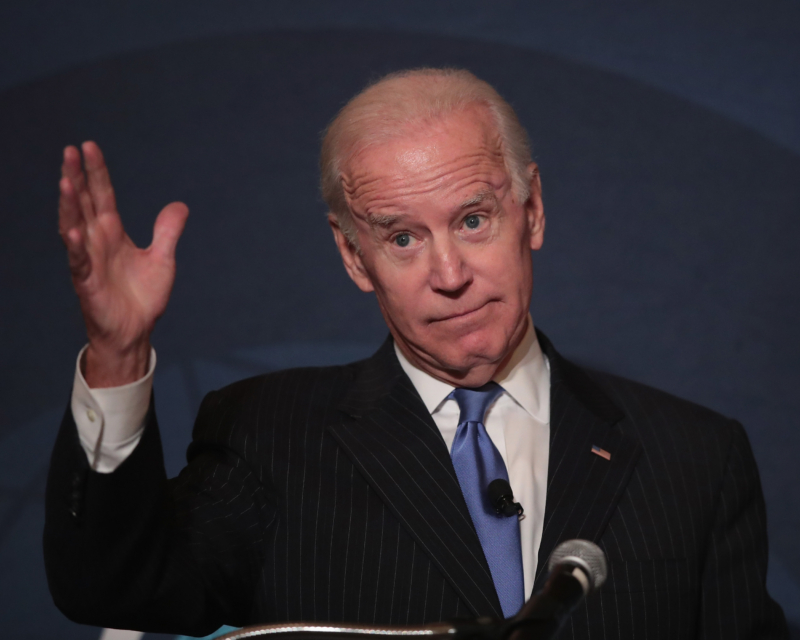

Speaking in Maryland last month while promoting his economic policies, President Biden emphasized the need for a fairer tax code, stating, “We ought to make the tax code more fair, not less fair. That’s why I promised that no one making under $400,000 will see their federal taxes go up a single penny.”

However, the day after President Biden’s remarks, Internal Revenue Service Commissioner Danny Werfel announced the agency’s expansion plans, specifically focusing on hiring personnel to target higher-income and complex tax areas, such as partnerships. This decision has raised concerns about the IRS’s ability to accurately identify and audit individuals meeting the $400,000 income threshold.

The Treasury Inspector General for Tax Administration (TIGTA) has pointed out that the IRS guidelines for high earners have remained unchanged since 1976 when anyone earning $200,000 was categorized as high income. The TIGTA also noted that the IRS had resisted formalizing the $400,000 threshold for high income because it wanted to maintain “agility” and flexibility in addressing emerging tax issues and trends.

Grover Norquist, president of Americans for Tax Reform, commented on the TIGTA’s findings, stating, “They have to convince the majority of Americans when they say they’re going to raise taxes, it doesn’t mean you.” Norquist called on House Republicans to subpoena the audits to reveal the truth behind the tax pledges.

During the debate over the Inflation Reduction Act in August 2022, every Senate Democrat voted against a proposed amendment to restrict new audits of taxpayers earning less than $400,000, effectively rejecting the limitation. The bill ultimately increased the IRS budget by $80 billion over ten years.

After signing the act into law, Treasury Secretary Janet Yellen assured the public in a letter to then-IRS Commissioner Charles Rettig that “small businesses or households earning $400,000 per year or less will not see an increase in the chances that they are audited.”

The IRS has responded to the concerns raised by stating that it is not increasing the audit rate for those earning less than $400,000. An IRS spokesperson clarified that the focus remains on pursuing high-income earners, partnerships, large corporations, and those abusing tax laws. The IRS maintains that the TIGTA’s recommendation does not impact its implementation of Secretary Yellen’s directive.

However, the TIGTA report argues that using a lower threshold for high-income taxpayers leads to more audits of a broader group of people, making these audits less productive. The report suggests that the IRS should accept Secretary Yellen’s directive to use $400,000 as the new high-income floor to improve its enforcement efforts.

Furthermore, the report highlights that IRS training of revenue agents for high-income examinations lacks a clear definition of individual high-income taxpayers, a finding that gains relevance considering the agency’s announcement of 3,700 new hires.

While the IRS’s intentions behind the hiring spree remain under scrutiny, the debate over tax audits, thresholds, and the definition of high-income earners continues to be a topic of discussion in the ongoing national tax policy conversation.