IRS Free File Opens for Tax Season 2024: Here’s What You Need to Know

In preparation for the upcoming tax season, the Internal Revenue Service (IRS) has officially opened the doors to its Free File program, allowing taxpayers to file their returns electronically at no cost. IRS Commissioner Danny Werfel emphasized the importance of providing taxpayers with various options, including tax software, professional assistance, and Free File.

The Free File program, developed in partnership with Free File Inc., offers a user-friendly platform for taxpayers to file their taxes quickly and easily. Commissioner Werfel stated, “Through the years, Free File has helped millions of taxpayers, and it remains an important option for people to consider using.”

How It Works

Taxpayers can visit IRS.gov/freefile to explore the Free File options available. If you have a specific software partner in mind, you can proceed directly to their platform. Alternatively, an “Browse All Trusted Partners” link is provided for users who wish to use an interview tool to identify the best product for their needs.

Upon selecting an IRS Free File offer, users will leave the IRS.gov website. However, the Free File providers will accept completed tax returns and hold them until the official opening of the filing season on January 29, 2024. It’s crucial to review the offers, as not all partners provide free preparation and filing for state returns. Any applicable fees must be disclosed on the company’s Free File landing page.

Eligibility

Each IRS Free File provider sets its eligibility rules based on factors such as age, income, and state residency. Typically, taxpayers with an adjusted gross income (AGI) of $79,000 or less in 2023 will find a product that matches their needs. The AGI can be found on line 11 of the previous year’s tax return.

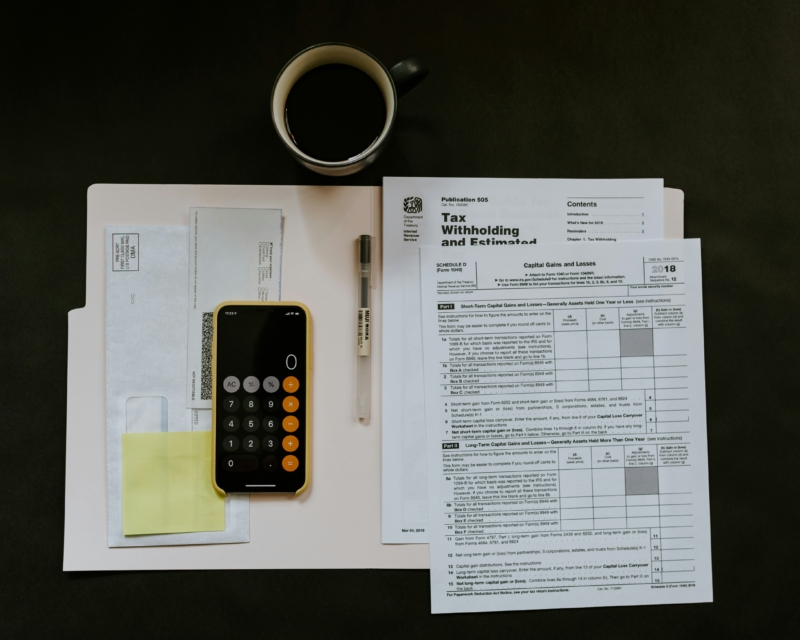

The IRS Free File Program covers commonly filed forms and schedules, including Itemized Deductions, Interest and Ordinary Dividends, Profit or Loss From Business, Capital Gains and Losses, Supplemental Income and Loss, and schedules for Earned Income Credit (EITC) and Self-Employment Tax.

Taxpayers do not need to purchase any software or use special equipment, as IRS Free File is accessible on smartphones and tablets, in addition to computers.

Background and Participants

The Free File program, established in 2003, is a public-private partnership between the IRS and Free File Inc. This partnership enables eligible taxpayers to access online tax preparation and filing software at no cost.

In recent years, the program faced controversy regarding allegations that some providers were directing taxpayers to paid services instead of the free options. To address these concerns, providers are now prohibited from hiding free filing services from search results, and users who don’t qualify for an IRS Free File offer can easily find alternative options on the Free File website.

For the 2024 tax season, some traditional Free File participants, including Intuit and H&R Block, have opted out. However, trusted partners such as 1040Now, Drake (1040.com), ezTaxReturn.com, FileYourTaxes.com, On-Line Taxes, TaxAct, TaxHawk (FreeTaxUSA), and TaxSlayer are participating.

Notably, ezTaxReturn.com will offer an IRS Free File product in Spanish for the upcoming tax filing season.

Another Option for Higher Incomes

Taxpayers with an AGI over $79,000 can utilize IRS Free File Fillable Forms, the electronic version of IRS paper forms. These forms will become available on January 29, 2024, providing an alternative for those comfortable using IRS form instructions and publications.

While some forms are not yet accessible, taxpayers can expect the Fillable Forms feature to be fully operational when the tax season officially kicks off later this month.